The Right Stock At The Right Time®

The Right Stock At The Right Time® The Right Stock At The Right Time® The Right Stock At The Right Time® |

|

||

|

Early Entries – Long & Short

The Market Edge Opinions are designed to provide users with conservative and reliable entry points for both long and short sale positions. The Opinions are typically correct about 70% of the time with the winners out performing the losers by a 3:1 ratio. However, because of the way that the Opinions are structured, a stock which is upgraded to Long typically has seen some price appreciation prior to the upgrade. The same is true for those stocks which are labeled as short-sale candidates.

In order for a stock‘s Opinion to be upgraded to Long, all of the indicators that are incorporated into the Power Rating (PR) must be positive resulting in a PR of greater than 59. Conversely, for a stock to be downgraded to Avoid, all of the indicators must be negative which will result in a PR of less than -26.

The Market Edge Opinions are cyclical in nature in that they generally traverse from Avoid to Neutral to Long and then back to Neutral and finally to Avoid. This is the scenario which occurs approximately 80% of the time. The other 20% of the time the cyclicality aborts as the Opinion moves from Avoid to Neutral but then reverses back to Avoid or from Long to Neutral and then back to Long. The 20% of occurrences makes initiating long or short positions when a stock is upgraded or downgraded to Neutral a risky business.

For those who would like to initiate positions when the Opinion is upgraded/downgraded to Neutral and are willing to accept the additional risk, the Market Edge ‘Early Entry’ reports are right up your alley. The Early Entry Long report includes those stocks whose Opinion has been upgraded from Avoid to Neutral, the U/D Volume Slope Ratio is positive and the stock is within 5% of its Entry Price which is its Buy Stop. It is recommended that long positions be initiated only when the stock closes above the Entry price. The Early Entry Short report includes those stocks whose Opinion has been downgraded from Long to Neutral, the U/D Volume Slope Ratio is negative and the stock is within 5% of its Entry Price which is its Sell Stop. It is recommended that short positions be initiated only when the stock closes below the Entry price.

The reason for waiting until the stock closes through the Entry Price is because the Buy and Sell Stops are usually good short-term resistance and support areas. When a stock violates these levels, it is a good indication that the price is likely to continue moving in that direction.

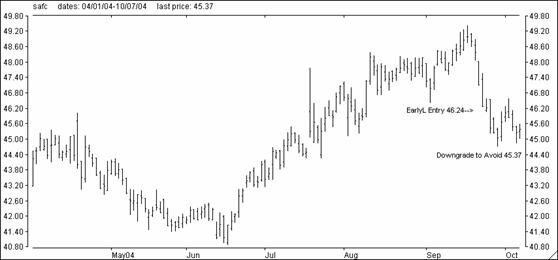

The following charts show an Early Entry Long (MOT) with an Entry Price of 16.66 and an Early Entry Short (SAFC) with an Entry Price of 46.24.

The Early Entry reports are located in the Stock Watch module. Click on the Select A List drop down and choose a list. Click on the Situations drop down and then select either Early Entry Longs or Early Entry Shorts. The Entry Price is located in the sixth column from the right. Changes can also be found in the Trading Ideas Module under the Trading Desk tab, changes are labled NYSE Short Term Buys and Shorts & NASDAQ Short Term Buys and Shorts.

|